30 Proven Stock Screens to Spot Ultra-Profitable Value Stocks (Download My Exact Screeners) - Part 1

All the details you need to run your own value screens and find profitable stocks before others do

Imagine spotting high-value stocks with untapped profit potential – long before they’re on everyone else’s radar.

That’s exactly what these 30 custom stock screens are designed to do. After years of testing, refining, and optimizing, I’m sharing the precise screens I use to identify the market’s most promising value stocks. You can download each screen instantly and start using them in minutes – no guesswork, no complex setup, just results-driven criteria ready to import and start working for you.

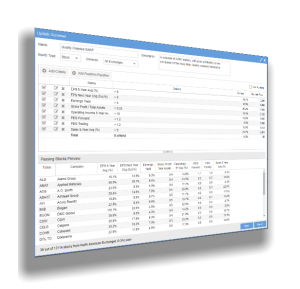

These screener files can be imported directly into your Stock Rover account and then you are ready to run them any time you wish. You can get a 2-week free trial of Stock Rover here (affiliate link).

If you prefer a different stock screener, no worries. Just use the screening criteria listed below in your favorite screener and you are off to the races.

How Are These Stock Screens Structured?

Here are a few important things to keep in mind as you go through these screens.

I run the same screener 3 times by changing the market cap range. That way I can screen for small and micro caps separately from mid-caps and large-caps. So essentially, there are only 10 unique stock screens, repeated 2 more times to cover a variety of market capitalizations.

Why do I split these up by market caps?

There are many reasons, here are three:

Some screeners are designed to give you the top 10 or Top N stocks that match the filters. If I run these screeners without controlling for the market caps, there is a good likelihood that the results will be dominated by only small-caps or large-caps. Even if there are stocks that fit these criteria, you may not see them. Splitting these out by market caps gives you more stocks to review

In most cases my analysis of a small cap stock differs from my analysis of large cap stocks, just because the size differential makes a few things possible. For example, large cap companies are able to access debt and equity markets easily for additional funding, while small companies may not have this ability. Small company stocks may be much less liquid than a large company stock. These are general observation and may be different case-by-case.

I lean towards smaller company stocks as this is where the mispricing is more likely to exist and can be substantial. Smaller company stocks are less followed and owned. Therefore, I have much better chances to beat the S&P500 using the small-cap value stocks than any other asset class.

Large-cap stocks on the other hand are well suited for dividend and quality strategies as they can be more stable and can withstand adverse economic conditions more robustly.

Below I am going to list all the screeners under just the small-cap category so I can describe them. You will also be able to access the individual screener for download and import. In the next email, you will see a list of the same screeners pre-configured for mid-caps and large-caps with a link to download the corresponding files. I will not repeat the description of the screening criteria there as you already know these from the small-cap section. The next email will also include dividend-oriented screeners, so make sure you get them as soon as they come out.

Remember, screening is just the first step towards finding profitable value stocks.

Second, you need to conduct due-diligence on each of the stocks, before you can make a buy or not buy decision.

Third, even when you decide to purchase, you still need to figure out whether this stock adds performance to your portfolio or subtracts performance from your portfolio. Not all great stocks are a buy. Think of your portfolio in a wholistic manner.

Fourth, if it passes this stringent test (which almost no one ever does), you still need to determine the optimal allocation percent to this stock in your portfolio. Too much will make your portfolio too risky and too little will not give you enough performance boost. So this needs to be an intelligent calculation, as we do at Astute Investor’s Calculus for our Premium and Founder’s Club members.

Finally, fifth, you need to understand the fair price of the stock and when to sell. Hold too long and your hard-earned profits will go kaput. Sell early and you will leave too much profit on the table.

If you want to maximize your portfolio returns at minimum volatility, and do not want to spend hours and hours of research every week, you are in luck right now. I already do this for my other paid members and I can do this for you.

But before you subscribe to our Premium or Founder’s Club plans, read this first.

The Small-Cap Value Stock Screeners

At Astute Investor’s Calculus, small-cap as defined includes micro-cap companies. We look for stocks in the market cap range of $30 million to $2 billion.

Do you have a different definition? Feel free to change this particular criteria to anything you want.

1. Small Cap Growth at a Reasonable Price Screener

A screener composed of Stock Rover GARP (growth at a reasonable price) metrics.

Criteria:

EPS 5-Year Avg (%) > 15

EPS Next Year Chg (Est.%) > 15

Earnings Yield > 5

Operating Income 5-Year Avg (%) > 15

PEG Forward < 1.2

PEG Trailing < 1.2

Sales 5-Year Avg (%) > 8

Exchange

Market Cap ($M USD) > 30 < 2000→ Get this screener to import in your Stock Rover account here (only 10 copies available)

You will need a Stock Rover subscription to import this screener file into.

Try Stock Rover Free for 2-weeks

2. Small Cap Piotroski High F-Score Screener

Small Cap - Piotroski High F-Score

This screener uses 9 criteria that look for companies that have solid financials that are getting better. The original 9-point system was developed by Joseph Piotroski, a professor of accounting. Passing companies must have a score of 9.

Criteria:

Piotroski F Score > 8

Exchange

Market Cap ($M USD) > 30 < 2000More detail on Piotroski F-Score criteria here.

→ Get this screener to import in your Stock Rover account here (only 10 copies available)

You will need a Stock Rover subscription to import this screener file into.

Try Stock Rover Free for 2-weeks

3. Small Cap Magic Formula Screener

Small Cap - Magic Formula Screener

A value screener based on the Magic Formula Investing principles that Joel Greenblatt lays out in his book The Little Book that Beats the Market.

Criteria:

Country

Market Cap ($M USD) > 30 < 2000

Sector: Basic Materials, Communication Services, Consumer Cyclical, Consumer Defensive, Energy, Healthcare, Industrials, Real Estate, Technology

Exchange

Rankings:

Highest Greenblatt Earnings Yield 50%

Highest Greenblatt ROC 50%→ Get this screener to import in your Stock Rover account here (only 10 copies available)

You will need a Stock Rover subscription to import this screener file into.

Try Stock Rover Free for 2-weeks

4. Small Cap Traditional Valuation Screener

Small Cap Value - Main Exchanges

Find small cap companies (between $30 million and $2 billion in market cap) that are inexpensive by traditional measures such as low price to earnings, price to sales and price to book. These companies should still be growing sales and earnings.

Criteria:

Market Cap ($M USD) > 30 < 2000

Price / Earnings > 2 < 10

Price / Sales < 2

Price / Book < 1.5

EPS 5-Year Avg (%) > 2

Sales 5-Year Avg (%) > 2

Exchange→ Get this screener to import in your Stock Rover account here (only 10 copies available)

You will need a Stock Rover subscription to import this screener file into.

Try Stock Rover Free for 2-weeks

5. Small Cap Margin of Safety Screener

Small Cap - Margin of Safety

Screen to find the 50 stocks that have the greatest margin of safety based on their computed fair value relative to their price.

Criteria:

Margin of Safety > 30

Margin of Safety (Academic) > 30

Margin of Safety EV to Sales > 30

Exchange

Market Cap ($M USD) > 30 < 2000

Rankings:

Highest Margin of Safety 40%

Highest Margin of Safety (Academic) 30%

Highest Margin of Safety EV to Sales 30%As you can see, Stock Rover already calculates the margin of safety for each stock in their universe, and you just have to select for it. I recommend you use this for first level screen, but you still conduct your own calculations to confirm or adjust the margin of safety for your purposes, based on your deeper understanding of the business.

Learn more about Margin of Safety criteria

→ Get this screener to import in your Stock Rover account here (only 10 copies available)

You will need a Stock Rover subscription to import this screener file into.

Try Stock Rover Free for 2-weeks

6. Small Cap Graham Enterprising Investor Screen

Small Cap - Graham Enterprising Screener

The Benjamin Graham Enterprising Screener focuses on intrinsic value based on a company's earnings, dividends, assets and financial strength. Note this screener uses for the P/E ratio the lowest 30% of sector, not of the market.

Criteria:

Country

Dividend Yield > 0

Equation: "Current Ratio [Now] " >=1.5

Equation: 0< "Long Term Debt [Now] " /( "Current Assets [Now] " - "Current Liabilities [Now] " )<1.1

Equation: "EPS [Y1] " >0 and "EPS [Y2] " >0 and "EPS [Y3] " >0 and "EPS [Y4] " >0 and "EPS [Y5] " > 0 and "EPS [Now] " >0

Equation: "EPS [Now] " > "EPS [Y5] "

Equation: "Price / Book [Now] " <=2

Price / Earnings Sector Decile < 4

Exchange

Market Cap ($M USD) > 30 < 2000As you have noticed, in Stock Rover (at least in the Premium Plus version), you are able to create fairly complex equations as your filters. This is extremely handy in finding exactly what you want. If you do not have this, you will have to take 1000s of rows of data in Excel and then do your own data analysis. Would you rather spend time in manipulating Excel, or would you prefer to spend time in analyzing stocks?

Learn more about Graham Enterprising Investor screen

→ Get this screener to import in your Stock Rover account here (only 10 copies available)

You will need a Stock Rover subscription to import this screener file into.

Try Stock Rover Free for 2-weeks

7. Small Cap Buffettology Inspired Screener

Small Cap - Buffettology Inspired

This screener is based on criteria described in the bestselling Buffettology book. The company should have a 10-year track record of generally increasing EPS with no negative earnings years; long-term debt not more than 5 times annual earnings; average ROE over the past ten years at least 15%, average ROIC over the last 10 years at least 12%, and earnings yield should be higher than the long term Treasury yield.

Criteria:

Earnings Yield > 3

Equation: "EPS [Now] " > "EPS [Y5] " and "EPS [Y5] " > "EPS [Y9] "

Equation: (( "Return on Equity [Now] " + "Return on Equity [Y1] " + "Return on Equity [Y2] " + "Return on Equity [Y3] " + "Return on Equity [Y4] " + "Return on Equity [Y5] " + "Return on Equity [Y6] " + "Return on Equity [Y7] " + "Return on Equity [Y8] " + "Return on Equity [Y9] " )/10)>=15

Equation: "Long Term Debt [Now] " <=(5* "Net Income [Now] " )

Equation: (( "ROIC [Now] " + "ROIC [Y1] " + "ROIC [Y2] " + "ROIC [Y3] " + "ROIC [Y4] " + "ROIC [Y5] " + "ROIC [Y6] " + "ROIC [Y7] " + "ROIC [Y8] " + "ROIC [Y9] " )/10)>=12

Equation: "EPS [Now] " >=0

Equation: "EPS [Y1] " >=0

Equation: "EPS [Y2] " >=0

Equation: "EPS [Y3] " >=0

Equation: "EPS [Y4] " >=0

Equation: "EPS [Y5] " >=0

Equation: "EPS [Y6] " >=0

Equation: "EPS [Y7] " >=0

Equation: "EPS [Y8] " >=0

Equation: "EPS [Y9] " >=0

Exchange

Market Cap ($M USD) > 30 < 2000You can adjust the long term treasury yield (the Earnings Yield filter) to match the current rates.

→ Get this screener to import in your Stock Rover account here (only 10 copies available)

You will need a Stock Rover subscription to import this screener file into.

Try Stock Rover Free for 2-weeks

8. Small Cap Low PEG companies

Small Cap - Low PEG Companies

Companies with the lowest trailing and forward PEG ratios along with low Price to Earnings and Price to Book ratios.

Criteria:

PEG Forward < 1

PEG Trailing < 1

Price / Book < 2

Price / Earnings < 12

Exchange

Market Cap ($M USD) > 30 < 2000→ Get this screener to import in your Stock Rover account here (only 10 copies available)

You will need a Stock Rover subscription to import this screener file into.

Try Stock Rover Free for 2-weeks

This is it for today and I hope you found real value in these screeners. In Part 2 of this post coming out in the next few days, I will include similar screeners for Mid Cap (8) and Large Cap (8) asset classes, and also dividend growth and dividend value screeners (6) for you to download and use.

So keep an eye on your email for 22 more screeners.

PS. If you have questions about any of these screeners, ask them below.

PPS. Share if you think this is a useful resource.

I look at new industries with the potential for disruption first. There are usually three top companies vying for dominance. Then it comes down to analyzing them and trying to figure out which will be the big winner a few years later. The good news is you need very few stocks to make money. I've never understood investors who invest in 10+ stocks (I never do more than 6). Although I admit it's subjective. If they have time to keep an eye on every company in their portfolios, they could do well too.

Thanks for this post. And I see you're a Stock Rover fan. Any thoughts on that service vs Stockopedia? And does Stock Rover do Europe? I gave the site a quick glance and didn't see anything beyond north america. Thanks, Joel