AIC Premium Newsletter Issue #1, 09-29-2024

Portfolio Updates, Strategy Insights, Commentary and Sector Spotlight

Hello Premium Members,

I want to extend a warm welcome to all of you. I am privileged to be able to offer my insights and help you in managing your portfolio and investments. With your Premium membership, you have access to my research and portfolio management strategies that aim to generate returns better than the market at the Portfolio level.

This is the first issue of the newsletter and I am sure it will evolve as the time goes on. If you have any requests for me to include in the newsletter, feel free to let me know and I will attend to it.

With that being said, let's begin.

What is Moving the Markets?

The Fed has started cutting interest rates. This brings to an end a long period of rising rates and expensive credit. This also ushers in a new cycle of cheaper mortgages, and loans, and for businesses, easier access to credit and working capital. The bond markets will see the yields go down and the bonds get dearer.

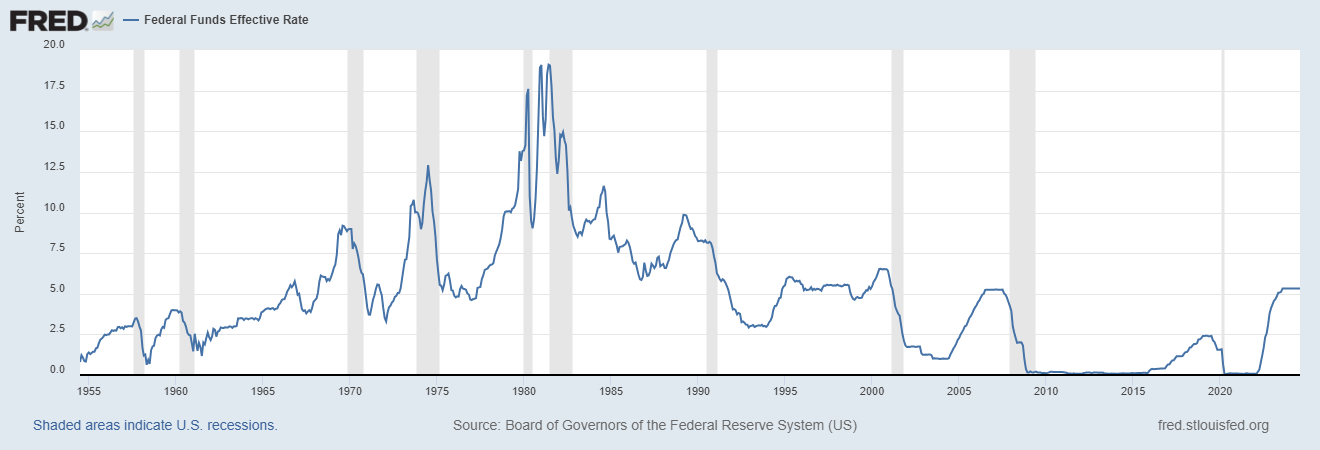

Of course the story is about inflation and many believe that the beginning of the rate cut cycle leads us into recession. There is ample historical data showing this. For example, consider the chart below that tracks the interest rates over the years. The greyed area represents recessions and you can see that the correlation between new rate cut cycle and a recessions is quite strong.

As I argue in this article, recessions tend to be brief and are not of much concern to a long term investor. They are however a good source of investment opportunities and we will definitely be on a look out for these, if we indeed end up with a recession or even a slowdown. Remember, cheaper credit will eventually lift all boats.

Sector Spotlight: Real Estate

The real estate markets have been frozen on the retail side in the recent years. High mortgage rates, and high property prices have left many potential home buyers unable to afford a home, even with solid income and prospects. While there is inventory on the market, it is not moving.

As the Fed funds rate declines, liquidity will return in the market. The mortgage rates will start to come down. The home prices are still expected to grow next year, although the growth rate will be much milder. Corelogic expects the Year-over-year price growth to moderate from 4.2% to 2.2% on average by July 2025.

On the commercial real estate side, we have seen the remote work trend causing many office vacancies. Return to work mandates will sop up some of the excess supply. On an intermediate to longer term, new business activity due to cheaper credit will work to bring the demand back into the market.

Deloitte believes that 2024 is the bottom of the commercial real estate market cycle. Although the growth expectations are modest, this may be a good time to position your investments to benefit from the cycle turning upwards.

So how do you play this opportunity?

Home builders, suppliers and home improvement stores like Home Depot and Lowes can all be great investments. On the commercial side, I expect Realty Income Corp, O 0.00%↑ to do well. If you want to take a passive position, Vanguards Real Estate Index ETF VNQ 0.00%↑ may be an option for you. I personally have an investment in RLTY 0.00%↑ a closed-end fund from Cohen & Steers, in my non-AIC portfolio where my primary goal is income. If you consider this, remember that this CEF operates with about 33% leverage, so it is higher volatility and it invests in both equity and debt.

Portfolio Updates and Strategy Insights

I have just completed my monthly revision of the portfolio allocation. This revision incorporates changes in asset prices, expected returns, risk-free rate, portfolio correlations and asset volatility. Normally you would expect that if stock price has gone down, than the allocation will increase, all other things being equal. On the other hand, if a stock has become more volatile, the allocation may go down to control our risk of loss, all other things being equal. Changing correlations with other assets in the portfolio will also affect relative allocations. This way we control the diversification within the portfolio and manage risk and optimize for performance.

The revised allocations have been posted on the Premium Portfolio tab. The following describes some of the salient changes: